Us Tax Rates 2026. Or with the potential to. See current federal tax brackets and rates based on your income and filing status.

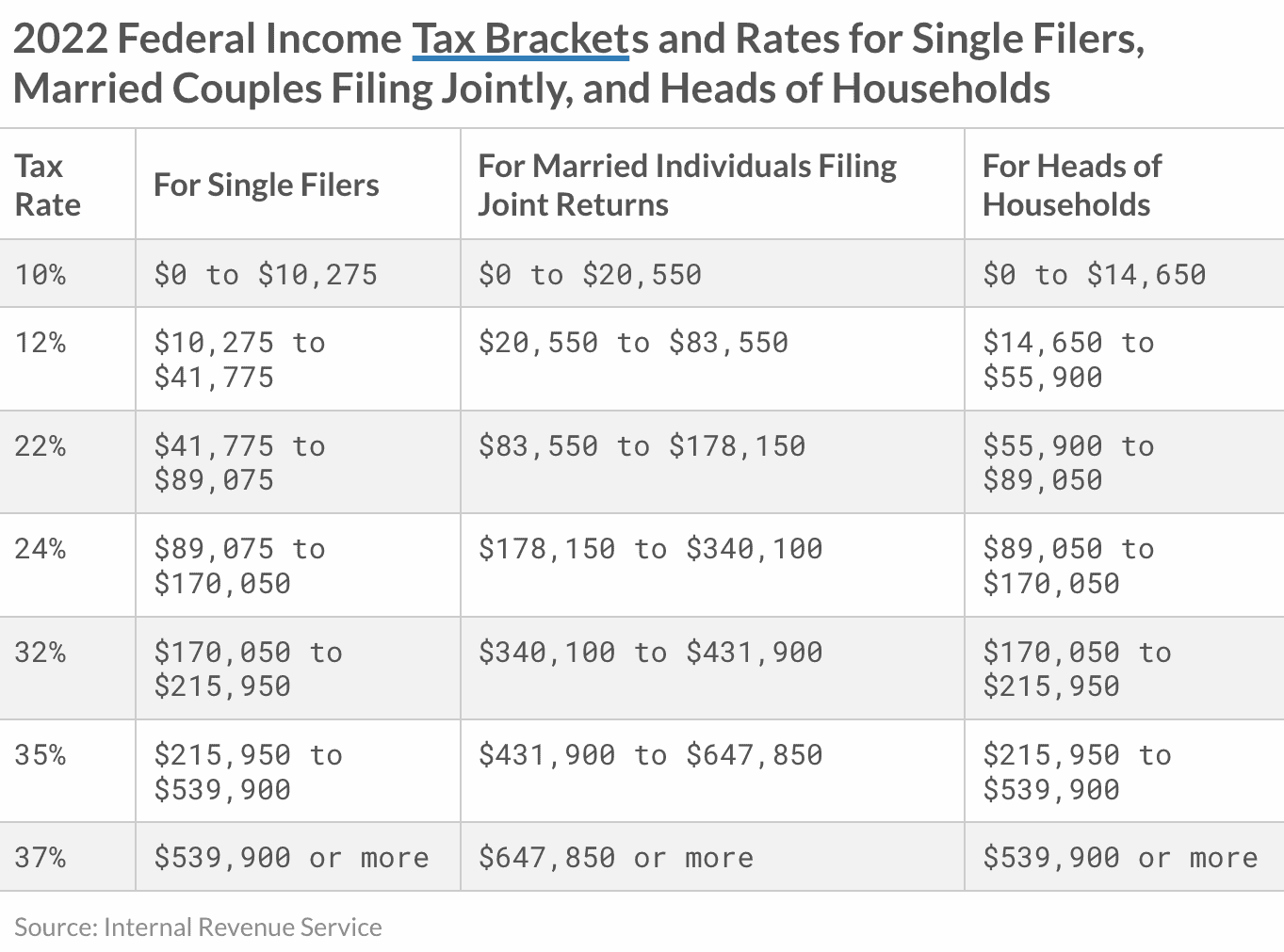

The federal income tax has seven tax rates in 2025: Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

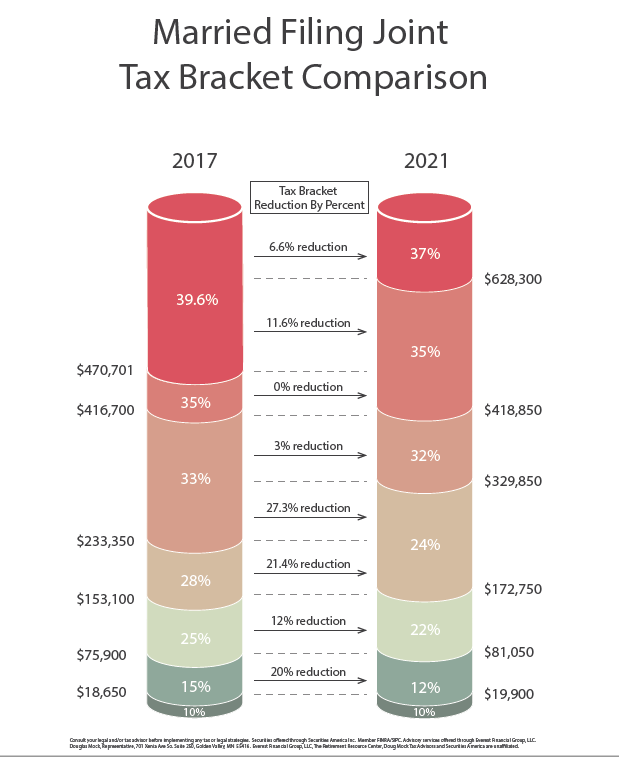

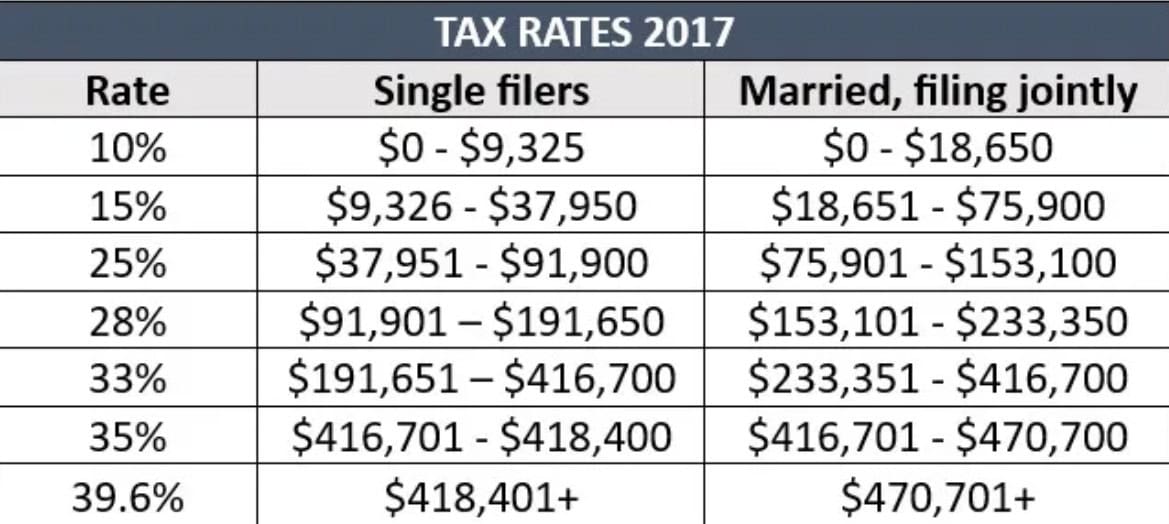

20252026 Tax Brackets A Comprehensive Overview Lydia Abbott, The 2017 tax cuts and jobs act (tcja) is set to end in december 2025, resulting in a federal estate exclusion that is less than half of the current am.

20252026 Tax Brackets A Comprehensive Overview Lydia Abbott, Among the tcja's many overhauls, it created a single flat corporate tax rate of 21%, raised the standard deduction for individuals and couples, increased the child tax credit.

T220080 Average Effective Federal Tax Rates All Tax Units, By, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Doug Mock Tax Advisors Tax Bracket Comparisons 20172026, The tax cuts and jobs act lowered the overall tax.

T220232 Tax Benefit of the Preferential Rates on LongTerm Capital, Skip to login skip to login skip to page content.

2025 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth, Here's a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare.

T220215 Tax Benefit of the Itemized Deduction for Real Estate Taxes, Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

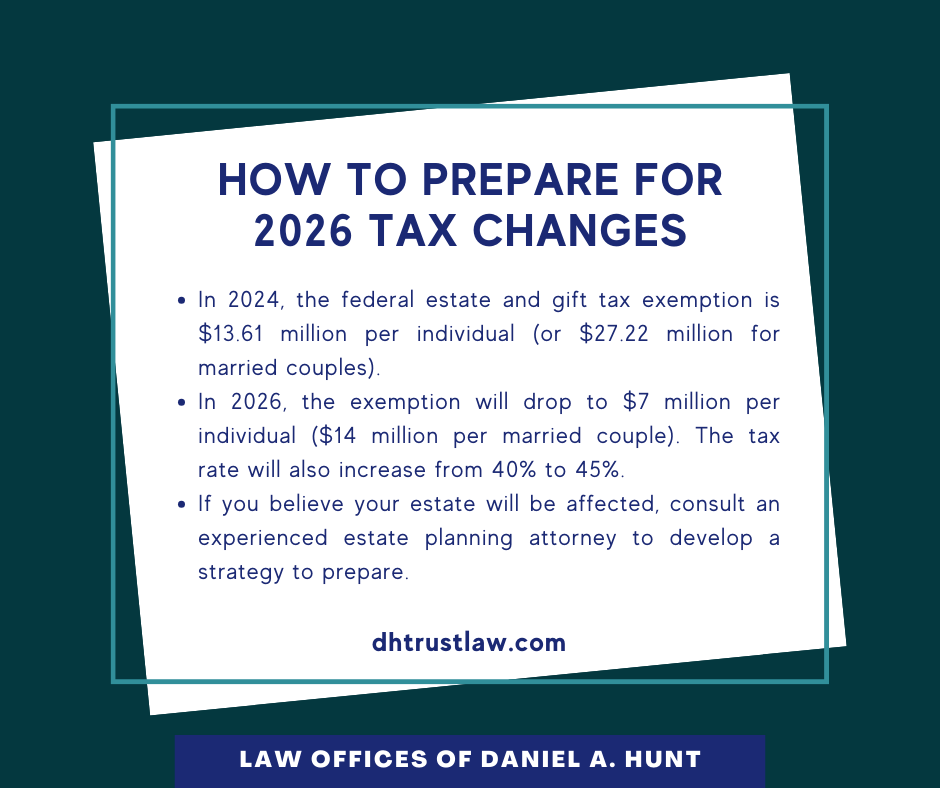

How to Prepare for 2026 Tax Changes • Law Offices of Daniel Hunt, Among the tcja's many overhauls, it created a single flat corporate tax rate of 21%, raised the standard deduction for individuals and couples, increased the child tax credit.

Doug Mock Tax Advisors Tax Bracket Comparisons 20172026, 2026 federal income tax brackets and rates overview by filing status , age and adjusted gross income.